State Investment Council CIO Vince Smith Recognized Among “Power 100”

Santa Fe, NM – The New Mexico State Investment Council (SIC) welcomes the recognition of Robert “Vince” Smith, CFA, deputy state investment officer and chief investment officer by Chief Investment Officer (CIO) magazine as one of their “Power 100” the best of the best in 2018. Smith has made the list for the last four years, climbing each year to be named among the top 20 worldwide, ranking 17th amongst his peers on this exclusive list.

According to CIO, “It’s easy to flourish in a bull market, but as we saw this year, anything can happen in an instant. Throughout a swath of selloffs and rallies, these esteemed asset owners kept their cool (and their patience) to deliver stellar returns and innovate new concepts to their strategy as they rolled with 2018’s punches.”

The rankings are based on innovation, collaboration, talent development, fund size and tenure. New Mexico Education Retirement Board’s chief investment officer, Bob Jacksha also made the list at #30.

Smith joined the SIC in 2010, as deputy state investment officer and chief investment officer. His role is to provide investment leadership for New Mexico’s sovereign wealth fund and other assets under management, a portfolio valued at $24 billion. The SIC investment teams implement a top‐down investment process, driven by macroeconomic analysis, long term strategy and strategic asset allocation. Throughout his career, Smith has provided investment leadership and fund management to both pension and sovereign wealth investment programs and he has more than three decades of investment experience across public funds in Montana, Texas, Kansas and New Mexico.

“I am deeply grateful to the SIC for the opportunity and wake up every morning – excited for another day,” said Robert “Vince” Smith, CFA, deputy state investment officer and chief investment officer for the SIC. “I could not be more proud and appreciative of the Council, investment team and our staff. This recognition reflects just as brightly on the SIC and all of the professionals I work with as it does me individually.”

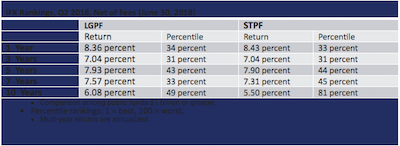

The percentiles in the chart below from Investor Force (IFX) Rankings, reflect where the SIC ranks against peer public funds with investments of $1 billion or greater. Best performing funds will rank in the first percentile, while worst will be 100th. The Land Grant Permanent Fund (LGPF) ranks above median, to top-third across 1, 3, 5, 7 and 10-year time periods. The Severance Tax Permanent (STPF) ranks above average across all years, except the 10-year metric. Steady, strong investment performance as shown below over many timeframes and in varied market conditions are hallmarks of the SIC’s investment program.

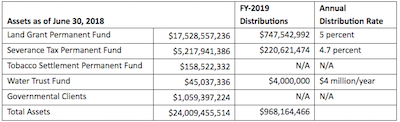

The SIC provides investment management for New Mexico’s permanent funds and for 20 government-related agencies from around the state. The total fund composite had a net asset value of $24 billion as of June 30, 2018.

As the value of the permanent funds grow, the financial benefit they provide to New Mexico grows. This fiscal year the funds will deliver $968 million to the general fund, most of which will go directly to fund public schools (approximately 75 percent). That’s about $70 million more than fiscal year 2018, and $130 million more than fiscal year 2017.

Fund growth in recent years has been driven not only by strong investment performance, but also by the boom in oil and gas exploration in southeast New Mexico. State mineral lease revenues flow into the LGPF, where they are then invested by the SIC across a diversified portfolio. The chart below shows the recent boom in oil and gas production.

For additional information about the State Investment Council and New Mexico’s sovereign wealth funds – currently the third largest in the U.S. – or if you’d like to read our 60 Years Anniversary Report 2018 or our current Investment Plan visit our website.