By Mike Bibb

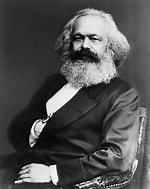

Karl Marx, German-born philosopher and political theorist, 1818-1883 Source: www.geo.de "Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the states, and without regard to any census or enumeration." — 16th Amendment, U.S. Constitution, ratified Feb. 3, 1913.

Karl Marx, German-born philosopher and political theorist, 1818-1883 Source: www.geo.de "Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the states, and without regard to any census or enumeration." — 16th Amendment, U.S. Constitution, ratified Feb. 3, 1913.

****************************

Now that income tax season is in full swing, most people are not aware of how it got started in the United States. They are, however, fully cognizant of its requirement and impact upon their lives.

"Pay your fair share" has been pounded into their brains for so long that it almost seems as essential as breathing.

Yet, has anyone ever heard a politician or IRS official describe what paying your fair share actually means? Is everyone's fair share the same? Or are some fair shares more fair than others?

Everyone knows what a sales tax is, what a property tax is, what a fuel tax is, what an inheritance tax is and what many other taxes are. They are described by their application.

Simply, if a person doesn't own property, then they are not liable for a property tax assessment. If they're a "naturalist," then they don't pay sales taxes on a pair of Levis. (But they will if purchasing SPF-80 sunscreen lotion.) If they don't purchase gas for a car, then they don't pay fuel taxes at the pump.

However, if they do all these things, then the tax is the same for everyone. Doesn't matter what their financial status is or how many tax deductions they are allowed.

But what is actually an income tax? More specifically, what is "income?" Does it affect everyone, or only those who actually receive it by performing certain tasks or businesses?

Since the tax is called an "Income tax," then it isn't an abstract term. Income must be as real as any other tax and pertains to something called "income." That is how it is described in the 16th Amendment.

After several failed attempts to enact a federal income tax, the Supreme Court eventually approved Congressional legislation because the single word "Income" was finally described to not be in violation of an individual's protection against direct taxation upon his labor or remuneration (payment) for his work. (Art. 1, Sec. 9, Par. 4, U.S. Constitution. Yes, this mandate is still in effect. Look it up. The 16th Amendment did not replace Art. 1, nor was Art. 1 repealed.)

The Court and Congress agreed that "income" was what was earned from the investment of capital (money or property owed or used in business) and of employment of labor to produce a product or service.

Seems reasonable and in compliance with Constitutional principles.

The "Industrial Revolution" and rise of national and multi-national corporations preceded the need for the government to find a way to tax these businesses without infringing upon the Constitutional rights of an ordinary worker.

The 16th Amendment was Congress' solution. Its contents are just as valid today as 112 years ago — only adherence to its meanings has been perverted.

In other words, private and corporate business may earn an income from items and services sold to the public, but an individual working for these businesses — who does not own a part of the business or receives other compensation from the business — is not subject to an income tax on his wages or salary.

For the simple reason he hasn't received any financial losses or gains from the business. He was only paid for his time and labor. Which isn't a financial gain. Merely an exchange of money for an individual's efforts to perform a certain chore.

As an example, an individual who works for a company that extracts copper ore out of the ground is paid a wage or salary — and maybe some additional benefits — for the job he/she performs. These are agreed terms between the employee and employer. There is no additional financial benefit to that person, and the company is not liable to pay the worker more than necessary.

Another obvious difference is that a company often passes its operating costs to the consumer, including labor expenses, within the price of its product. A private worker can't since he/she is not making or selling the item for the benefit of himself. He's merely fabricating something for his employer to sell to the public.

An ordinary worker does not issue and sell stock certificates on himself or pay quarterly dividends on his services. Public companies do.

Nor does an ordinary worker have platoons of lawyers and accountants to figure out ways to work around or minimalize the income tax burden.

His tax deductions are determined by the very agency collecting the taxes — the Internal Revenue Service.

The tax code is riddled with similar discrepancies and nonsensical regulations, often incomprehensible.

As a result, the supposed "fairness" of the system is inherently rigged in favor of the government and wealthy corporations.

Needless to say, the days of a person's wages being income tax free have long passed. To such an extent, that if an individual fails to file his annual tax forms, he can become subject to audit, investigation, fines, indictment and prosecution.

How can this be? What has changed since 1913 that now requires a person to submit to the yearly ritual, whether he had an income or was required to file? How did a person's wages lawfully become income?

In my opinion, it is not because the Constitution has changed, or the definition of income has been repurposed. If these events had taken place, I'm sure they would have been publicly advertised and widely discussed on social media.

Nevertheless, convincing a federal court of the merits of these arguments is nearly impossible for the obvious reason the courts, IRS and the entire government apparatus is dependent on the revenue received by this form of taxation.

It's much more expedient to simply ignore the issue, limit or disallow opposing evidence, or prosecute on another charge.

The fact the individual income tax lawfulness is highly questionable, even that yearly lump of money hasn't prevented our leaders and officials from plunging us into a $36 trillion-dollar financial sinkhole.

It's absolute insanity.

What the hell has happened? We're not getting very good results from the amount of money being taken from us.

Long ago, tariffs on imported goods into our country were a substantial form of revenue for the government. It is still mentioned in the Constitution.

The 16th Amendment in 1913 widened the revenue taxing concept to include profits and gains made from income by companies and individuals employing people to produce or make a product for sale.

Since then, it has intentionally evolved into a government pickpocket scam on American workers.

Over the past hundred years, the tax has morphed from involving primarily businesses to virtually everyone receiving money for anything. Including a tax upon a person's right to work.

Over 150 years ago, philosopher and political theorist Karl Marx uttered his famous "From each according to his ability, to each according to his needs" diatribe. The twisted logic became one of the tenets of the Communist Manifesto, and the theme in George Orwell's 1945 novel "Animal Farm."

Today, readers may notice the suspicious similarity between the redundant "Pay your fair share" dictum and Marx's mumblings.

Each is as vague in logic and meaning as the other.

Where is the lawful authority for the government to act as originator, advocate, defender, judge, jury and enforcer of the fair share tax doctrine cited? A subject of this magnitude must be well documented and upheld by Supreme Court decisions.

Actually, where in the tax code is the definition of "income" found? Not what the IRS considers income, but the real definitive legal dictionary meaning of the word?

Somewhere along the way we've drifted from a society managed by a government adhering to taxing principles limited by Constitutional prohibitions, to an out-of-control revenue collecting agency in need of immediate reform, downsizing and criminal investigation.

From the top to the bottom and every department in between. It's time a broom is laid to this convoluted organization, sweeping out decades of accumulated abuse, misapplication of law and removal of a bureaucracy that has become accustomed to doing things its own way by trampling upon the rights of others.

With a President and Congress now looking into the "birth right" discussion of the 14th Amendment and application of tariffs, maybe they should equally be concerned over the widely mismanaged and deceptive income taxation controversy.

It is, obviously, a situation adversely affecting more Americans than suspicious births by noncitizens.

Finally, the authors of the Constitution included one last mandate to make sure their decisions were complied with. Art. 6 — often referred to as the "pursuance clause" — clearly confirms the Constitution is the "supreme law of the land" and every judge in every state is bound by its contents.

Including those deciding tax policies and their proper application.

And please, don't bring up the subject of Jesus' "Render unto Caesar" admonition (Matt. 22:21), as if it's proclaimed in the Bible we're expected to pay income taxes or risk the wrath of the Roman Empire (IRS).

Old Caesar and his insolent ilk were tossed from Independence Hall in Philadelphia on July 4, 1776, further restrained on Sept. 17, 1787 and permanently shackled by the 16th Amendment in 1913. Unless Constitutional guidelines are explicitly followed when extracting tributes.

Caesar may still be a loud noise in Italy, but around here he just another thieving punk.